Typically, 75% of a business owner’s net worth is in his or her business. How do business owners transition from active business owner to happy retiree? It takes planning. All business owners can establish a private qualified retirement plan to shift assets from their business to their personal wealth.

The government established private qualified retirement plans specifically to enable businesses to create retirement benefits for employees. A qualified retirement plan meets the requirements of the Internal Revenue Code and, as a result, comes with tax advantages and security unavailable in other strategies.

Business owners should choose a qualified retirement plan because:

- Contributions to the plan are tax deductible.

- Contributions aren’t currently income taxable.

- Plan earnings grow tax-deferred until they are withdrawn.

- There is no income tax on net insured death benefits.

- They provide savings at retirement.

- Distributions can be rolled into an IRA and stretched over the beneficiary’s lifetime.

- They generally are protected from the claims of creditors.

- They provide guaranteed retirement benefits.

- The provide income tax-free death benefits.

A business owner earning $175,000 annually pays $50,750 each year in taxes (assumed combined federal and state 29% bracket). Over 25 years, this equates to $1,268,750 paid in taxes. If the business adopts a qualified retirement plan and contributes $55,000, the business owner will save $15,950 in current income taxes.

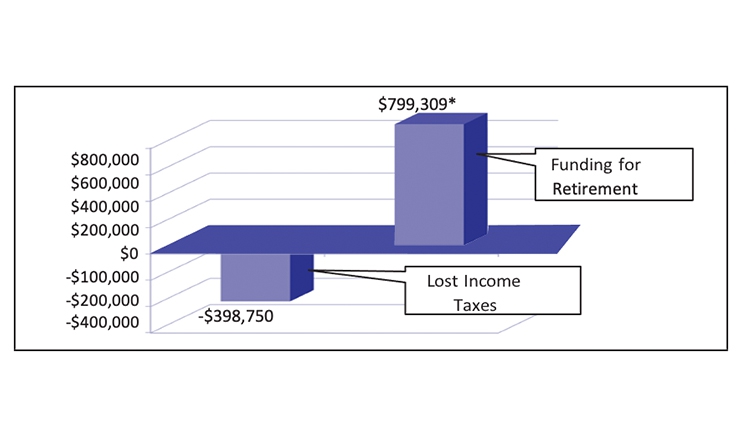

Over 25 years, this equates to $398,750 of tax savings that are instead put to work for the business owner ($15,950 x 25). Assuming a 5% interest rate, the tax savings alone could grow to more than $799,000 for retirement (see the figure).

Are you ready to plan for your transition from active business owner to happy retiree? You can build your plan in six simple steps:.

- Establish a fund transition plan.

- Define your goals, meet with a professional, and establish a qualified retirement plan custom designed to benefit you.

- Consider protecting your benefit with life insurance.

- Fund your plan.

- Make a distribution and wealth transfer plan.

- Hire a third-party administrator to maintain your plan.

Get ready and begin. Give yourself the retirement you deserve.

Ms. Read is national director of pension and protection planning at Pentegra Retirement Services and partner of M&R Business Development Group. A leading authority in qualified retirement plans with more than 30 years’ experience, she has an extensive background in plan design and development and experience as a marketing executive, financial professional, pension analyst, and pension compliance manager. She is a frequent speaker on qualified plans and contributor to industry publications. And, she is the author of three books.

Mr. Competelli is president and CEO of National Retirement Group and a former BENCOR regional manager. He is a graduate of the State University System of New York at Farmingdale with a degree in finance. He started his own corporation, Financial Reserve Services, in 1990, which he sold to USRP in December 2009. He began working with BENCOR in 2005. He also is a certified tax preparer through AARP, volunteering with local chapters of the Lighthouse of the Blind in preparing tax returns. For more information, contact financialfocus100@gmail.com.

Related Articles

The Tax Cut and Jobs Act of 2017 Can Impact Dentists’ Retirement

Choosing Between a Traditional and a Roth 401(k)

Retirement Reality: Going Beyond “What’s Your Number?”