So much has happened that the Tax Cut and Jobs Act of 2017 seems like long ago history. But its effects are still real and affecting dental practices today. Section 199A of the act provided a new 20% deduction of qualified business income for certain pass-through businesses such as dental practices, which include:

- Sole proprietorships (no entity, Schedule C)

- Real estate investors (no entity, Schedule E)

- Disregarded entitites (single-member LLCs)

- Multi-member LLCs

- Any entity taxed as an S corporation

- Trusts and estates, real estate investment trusts (REITs), and qualified cooperatives

However, personal service businesses lose this deduction when their taxable income exceeds the following thresholds (annually adjusted for cost of living):

- $157,500, phased out by $207,500 for single taxpayers

- $315,000, phased out by $415,000 for married filing joint payers

Section 199A service businesses include dentists and doctors as well as athletes, attorneys, brokers, consultants, CPAs, financial advisors, and the performing arts

When income exceeds the phase-out threshold, the 20% deduction is lost. Making a contribution to a qualified plan can create a deduction that will bring taxable income below the phase-out threshold, regaining the 20% deduction in addition to the deduction for the qualified plan contribution.

Meet Mark and Cindy

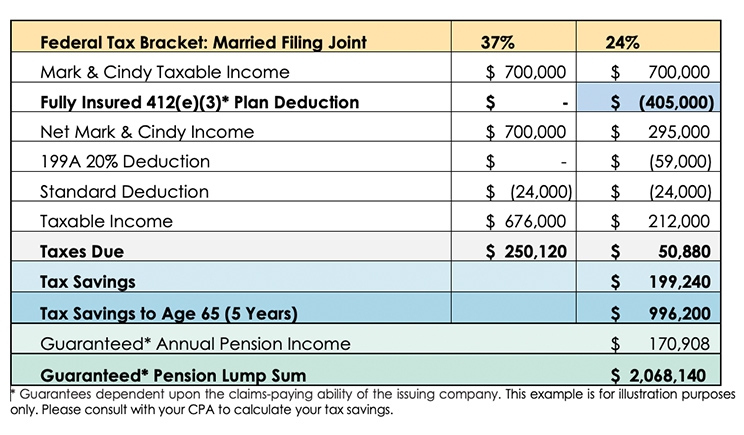

Consultants Mark and Cindy are both 60 years old and making $700,000 in combined net business income. They file their tax return as married, joint.

- Mark and Cindy can contribute $405,000 to a Fully Insured 412(e)(3) Defined Benefit Plan.

- Mark and Cindy get a full deduction for the $405,000 Fully Insured 412(e)(3) Defined Benefit Plan contribution, lowering their taxable income to a level where they will also qualify for an additional Section 199A deduction of $59,000.

- Contributing to the Fully Insured 412(e)(3) Defined Benefit Plan contribution reduces their current tax liability by $199,240.

- Tax savings add up to $996,200 by the time Mark & Cindy turn 65.

- Mark and Cindy will be able to retire at age 65 with a combined pension income of $170,908 per year and will have lump sum balances totaling $2,068,240 (see the table).

For Mark and Cindy, the decision to implement a Fully Insured 412(e)(3) Defined Benefit Plan or not is a $2,946,540 decision! They can either pay $1,250,600 in taxes over the next five years, or they could save $2,068,140 in their Fully Insured 412(e)(3) Plan.

The adoption of a Fully Insured 412(e)(3) Defined Benefit Plan meaningfully reduces the estimated current tax liability and brings their taxable income below the new 199A deduction threshold limits, regaining the 20% deduction. The Fully Insured 412(e)(3) Defined Benefit Plan also created significant pension income without market risk.

Your Situation

- Do you have your 20% deduction?

- Do you want to meaningfully reduce your current tax liability?

- Do you want the IRS to help you accumulate assets for your retirement?

- Would you like a secure pension income with peace of mind?

Ms. Read is national director of pension and protection planning at Pentegra Retirement Services and partner of M&R Business Development Group. A leading authority in qualified retirement plans with more than 30 years’ experience, she has an extensive background in plan design and development and experience as a marketing executive, financial professional, pension analyst, and pension compliance manager. She is a frequent speaker on qualified plans and contributor to industry publications. And, she is the author of three books.

Mr. Competelli is president and CEO of National Retirement Group and a former BENCOR regional manager. He is a graduate of the State University System of New York at Farmingdale with a degree in finance. He started his own corporation, Financial Reserve Services, in 1990, which he sold to USRP in December 2009. He began working with BENCOR in 2005. He also is a certified tax preparer through AARP, volunteering with local chapters of the Lighthouse of the Blind in preparing tax returns. For more information, contact financialfocus100@gmail.com.

Related Articles

Choosing Between a Traditional and a Roth 401(k)

Retirement Reality: Going Beyond “What’s Your Number?”

Use the DDSO Model to Secure Your Retirement