That you never learned in dental school was what to do if disability struck and you could no longer perform clinical dentistry. When you purchased disability insurance for this purpose, no one could foresee the future of the disability insurance industry.

By the 1980s, healthcare professionals were the favorite “target market” of insurance companies writing disability insurance policies. Competition was extreme between various insurance companies vying for increased market share. As a result, contract benefits were expanded, language was liberalized, and underwriting standards were often relaxed.

However, by the 1990s, the disability insurance climate began to change dramatically. As claims increased, companies began to lose money on their disability lines. As a result of those financial realities, the business changed, with companies consolidating through mergers and acquisitions and restructuring the way claims were handled. The “name of the game” became figuring out a way to make those lines profitable. As a result, disability insurance companies began looking at claims with a hard-line attitude. They started becoming more aggressive in creating and implementing sophisticated strategies to lessen their liabilities. In a nutshell, it’s now all about figuring out a way not to pay.

What is the biggest and most prized target of the companys’ aggressive tactics? It’s the dentists and other healthcare professionals with those larger policies, with that liberalized contract language, and with those extended benefit periods. The most efficient way to convert a liability into an asset is to knock out the big claims. With that reality, this article is written as a guideline to provide you, the insured dentist, with a basic understanding of what to expect when engaging your disability insurance company.

THE POLICIES

Essentially, a dentist may be insured under 2 types of policies: the Individual Disability Income policy (DI policy) or the Group Policy or Long-Term Disability policy (LTD policy). Group policies are generally controlled by the Employee Retirement Income Security Act of 1974 (ERISA). The most important aspect of your claim is to make sure that you understand your policy and all policy provisions. Remember, your policy is a contract, and you must satisfy all pertinent policy provisions in order to obligate your disability insurance company to pay you monthly disability benefits.

The Long-Term Disability Policy (LTD Policy)

LTD policies, usually part of an employee benefit package, are inherently inferior to DI policies. This is essentially because of restrictive contract language, the requirements and application of ERISA, and a host of company-friendly court decisions. The reason that LTD policies cost (on average) about one sixth of the premium of a quality DI policy is because LTD policies are designed to limit coverage and the amount of benefits payable. The LTD policy (per capita) is cheaper, easier to sell, easier to administrate, and in every way more profitable for the disability insurance company. In view of the diminishing profit on the DI lines, there is no question that LTD policies are the high-growth area of the industry. Below you will find a list of important LTD policy provisions:

(1) Coverage. The policy will determine whether or not an employee is provided coverage, which is usually limited to active, full-time employees.

(2) Pre-existing Conditions. Generally, a pre-existing condition is limited to a condition that existed within 3 months prior to the policy’s effective date and disabled the insured dentist within 12 months after the effective date. If a condition meets that criterion, it will be excluded from coverage.

(3) Total Disability. Most LTD policies initially provide a definition that is usually the inability to perform the material and substantial duties of your own occupation. However, often after 2 years the definition changes to the inability to perform the material and substantial duties of any occupation for which the insured is reasonably fitted by education, training, or experience. Also, sometimes there is an earnings loss threshold as part of the definition.

(4) Residual or Partial Disability. This is often defined as the ability to perform one or more of the material and substantial duties of your own occupation, or as disabled but working and earning more than 20% but not greater than 80% of the predisability monthly income. Partial benefits paid under this provision are usually considered in combination with earnings or on a pro-rata basis consistent with the percentage of earnings lost.

(5) Offset Provisions. LTD benefits are generally reduced by the receipt of other related benefits, such as worker’s compensation or social security disability.

(6) Mental Illness Limitation. Most policies include a provision that limits a disabling condition as a result of mental illness to a benefit period of 2 years. There are exceptions to this rule.

(7) Self-Reported Limitation. Some policies include an additional limitation for claims that are based on self-reported symptoms, which cannot be verified by objective testing, to a benefit period of 2 years.

(8) Physician’s Care. LTD policies usually have the most demanding language in the physician’s care requirement, which is usually appropriate care rising to the level of standard of care.

You must also understand the specific procedures, as required by ERISA, during the pendency of a claim. The ERISA procedures are, in essence, an administrative process. Each policy provides the insured dentist with the specific procedure to be followed during the claims process. Most importantly, ERISA has established an internal appeals process in the event of an adverse decision of your claim, which both sides must adhere to. It is only after this appeals process has been exhausted that you have the right to file a lawsuit in court. In the event of an adverse decision, usually you must show that the claims administrator has acted “arbitrarily and capriciously” in reaching the decision on your claim. This is an extremely difficult burden to meet. You must also overcome that host of company-friendly court decisions that will stand in the way of receiving your benefits.

The Individual Disability Income Policy (DI Policy)

Individual Disability Income policies are far superior to LTD policies. This especially holds true for most policies issued in the 1980s and early 1990s. Even DI policies sold today, although largely revised and not nearly as good as the older policies, are most often much better than LTD policies and are still very important to have. Below you will find a list of important DI policy provisions:

(1) Total Disability. This usually means the inability to perform the material and substantial duties, or important duties, of your regular or own occupation. In addition, there is a physician’s care requirement that varies by policy.

(2) Residual Disability. This usually means the ability to perform one or more of the material and substantial or important duties, or the ability to perform all duties but for less time. It contains an income loss requirement and the physician’s care requirement.

(3) Physician’s Care. The care provisions include those ranging from care of a physician, regular care, and attendance of a physician, to receiving care that is appropriate for the condition causing the disability. The term physician is usually generic.

(4) Pre-Existing Condition. A pre-existing condition is a nondisclosed condition that ex-isted prior to the issuance of the policy that the company will attempt to exclude from coverage. This is usually a condition for which medical attention, advice, or treatment has been sought or received or often for which the reasonably prudent person would have sought or received.

(5) Incontestability Clause. Usually after a disability insurance policy has been in effect for 2 years, the company can no longer contest the policy. How-ever, the contestability of the policy depends on the specific language contained in the incontestable clause. There are essentially 2 types of incontestable clauses. In the first, the company’s right to contest the information contained in the ap-plication to the policy ends after 2 years. In the second, the company retains the ability to contest the policy after 2 years if the application contains “fraudulent misstatements.”

The procedure for filing a DI claim is set forth in the policy. While the procedure may appear to be simple, the process is very complicated, time-consuming, and a minefield of issues, defenses, and strategies that must be considered and anticipated when filing and maintaining a claim.

While there is clearly the right to bring a claim for bad faith against your disability insurance company in a DI case, your right to do so in an LTD case is a totally different matter. Multiple federal court cases had been decided on this issue that have led to the most recent major federal court decisions: (1) Aetna Health, Inc v Davila and (2) Barber v UNUM Provident. In Davila, which was a non-LTD case, the United States Sup-reme Court ruled that ERISA pre-empts state law causes of action. Barber, a third Circuit Court of Appeals decision, held in an LTD case that ERISA pre-empts the Pennsylvania In-surance Bad Faith Statute. It is unfortunately clear that the US Supreme Court would likely rule that a state Bad Faith claim in an LTD case is pre-empted by ERISA.

Treating Physician Rule

Under social security law, the treating physician’s opinion is accorded more weight and given deference compared to opinions from social security-appointed doctors. The concept developed because it was obvious that the treating physician, who had a physician/patient relationship and had provided hands-on medical care, was in a better, more informed position to render opinions to be considered in a disability claim. There was inconsistency between the federal courts as to whether the Treating Physician Rule was applied in LTD cases. However, in Black and Decker Disability Plan v Nord, the US Supreme Court determined that no special deference was to be given to opinions of treating physicians, effectively doing away with the Treating Physician Rule in LTD cases. However, opinions of treating physicians are extremely important and must be appropriately considered by the LTD carrier.

Procedural Defenses

There are a host of potential defenses, which I refer to as “procedural defenses,” to which the company will look in order not to be obligated to pay the claim without even considering the merits of the claim itself. Common issues include coverage, eligibility, and pre-existing conditions under LTD claims, and pre-existing conditions and the incontestability clause under DI claims. Essentially, by employing these defenses, the company will attempt to show that an employee is not eligible under the policy or provided coverage, or that the policy can be rescinded, and therefore the claimant is not entitled to benefits.

Legal and Social Disability

Pursuant to the policies, you must be disabled as a result of injury or sickness. In other words, you must be “factually disabled.” “Legal disability” is the inability to practice dentistry as a result of loss of licensure, criminal charges, or some other legal basis. “Social disability” is the inability to practice as a result of social concerns. If the facts of your claim can be applied to either legal disability or social disability, then the company will argue that you will not be entitled to benefits. Each case is very fact-specific as to whether these defenses will prevail.

Dual Occupation/Residual Disability

Your occupation is determined at the time you become disabled. The companies will always at-tempt to consider an occupational scenario in its own most favorable light. This is accomplished by arguing that the insured was engaged in multiple occupations or is able to perform some of the important duties of his or her own occupation, thereby causing the insured to be either not disabled or residually disabled, instead of totally disabled.

Appropriate Care

During the claims process, when you are most vulnerable and in need of income, the company will often seemingly make the process too invasive and demanding to the extent that you will back down and walk away from the claim. The company will often relentlessly request and require unending amounts of information and documentation, some of which may be extremely time-consuming to obtain or impossible to provide. This can be the basis for the company’s position either to deny or to be unable to consider a claim.

STRATEGY

Below are the “10 Com-mandments” of a disability insurance claim, which should be followed by the insured dentist when considering a claim:

(1) Knoweth Thy Policy. Remember, we are talking about contractual obligations—you have them, too. Make sure you know what you have to satisfy in order to obligate the company to provide you with benefits.

(2) Knoweth Thy Issues. You may face one or more of a myriad of legal issues when your claim is evaluated by the insurance company, including those I have set forth above. You will need to anticipate the application and effect of all issues and defenses in the prosecution of your claim.

(3) Knoweth Thy Own Occupation. Know specifically what is material and substantial or important in your own occupation(s). Make sure your treating medical professionals know them too. Consider not only your specific duties performed, but also how much of your time is spent and revenue raised with each particular activity.

(4) Knoweth Thy Medical Professionals. You must choose healthcare professionals whom you trust, who provide you with appropriate care, who are well-credentialed, and who have experience in treating your disabling condition. Also, be sure they will participate in the claims process and do so in a timely fashion.

(5) Spareth Thy Forked Tongue. Always maintain open lines of communication with the disability insurance company. Provide them with appropriate and necessary information as well as the required completed forms in a timely manner.

(6) Keepeth Thy Disability File. Create a parallel file to that of the disability insurance company that contains copies of all correspondence to and from the carrier, your claim form and other documents submitted to initiate your claim, your attending physician statements and monthly insured statements submitted to the company, any relevant medical documentation obtained, and copies of other pertinent information. Also, keep an activity run sheet, documenting all contacts, telephone or otherwise, with the company.

(7) Giveth Them the Wrath of Thy Paper. When prosecuting an LTD claim, you must paper the LTD carrier’s file literally with the “sun, moon, and stars.” You must anticipate every aspect of your claim and then provide strong supporting documentation, medically and otherwise, which will satisfy all contract language as well as your burden of proof.

(8) Knoweth Thy Neighbor. You must understand that at any time during the claims process you may (or will) be subjected to the company’s strategies intended to discredit your claim. These include developing information to establish an inconsistency between the activities you have advised that you can and cannot perform or between what you do perform and what one would expect that you can perform, given your disabling condition. The company will often accomplish this by way of field representative meetings, surveillance, or other investigation.

(9) Knoweth Thy Burden. Essentially, you and your treating doctors need to establish the restrictions and limitations you face as a result of the condition(s) from which you suffer and how those “restrictions and limitations” prevent you from performing the material and substantial or important duties of your own occupation. Make sure any opinions are medically well-founded. Understand that any information you submit for your claim will be scrutinized by the disability insurance company’s claims department and its internal and external staff of medical “ex-perts” and consultants.

(10) Thou Shalt Be Proactive. Always be proactive, consider all medical alternatives, and stay in control of your claim ahead of the disability insurance company’s agenda.

CONCLUSION

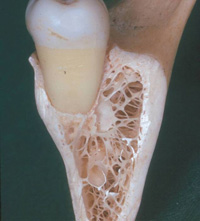

I think by now you get the picture. In the event of disability, you may be in for the fight of your life. You will need to have a full understanding of your contract and be fully proficient in the multiple defenses and strategies with which the disability insurance company to which you look for benefits will be armed. You will need to be familiar with relevant case law, statutes, and techniques at the company’s disposal that will be employed in considering and defending your claim. Your policy, your claim, or your case may even be your largest asset. Treat it as such. Don’t let the inability to put your hands in a mouth cost you an arm and a leg.

Mr. Seltzer is an attorney practicing in Philadelphia, Pa, nationally representing healthcare and other professionals with disability insurance claims. He can be reached at (888) 699-4222 or by visiting seltzerlegal.com.