Those of us who wore braces when we were younger can thank our orthodontists for the straight teeth we have now. And, the growing number of people who have had their teeth straightened as adults are also indebted to their orthodontists. But today’s families may hesitate before getting necessary treatment because of the costs and the complications involving insurance and payment.

Many dental plans cover orthodontics, but the coverage often differs from other dental services. Patients will usually pay a higher share of the cost, coverage may be limited to children, and there is often a lifetime maximum. Helping the families you treat understand the details of their plan and their payment options now can help them get ready for the time when they may need orthodontic care.

When Is It Time for the Orthodontist?

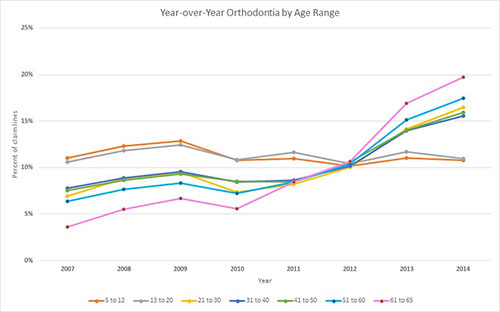

Orthodontic services are most common for children, although many adults now seek them, too. Whether such services are deemed medically necessary (which may make them more likely to be covered) or cosmetic, FAIR Health data show that private insurance claim lines for orthodontic services rose more steeply for adults than for children from 2007 to 2014 (see the figure).

|

The percent of claim lines stayed at about 11% from beginning to end of the period for the age ranges 5 to 12 years and 13 to 20 years, but increased sharply for all older age ranges, with the biggest increase seen among people aged 61 to 65 years: a fivefold increase from 4% to 20%. Still, most orthodontic care is prescribed for children.

How Do You Get Paid?

Even if your patients’ dental plans cover orthodontics, they most likely still will have out-of-pocket costs. Because orthodontic services continue for a long period of time, it’s beneficial for practitioners and patients alike when orthodontists offer a number of ways to pay. These may include:

- Installment payments, spread out during the course of the treatment: With this option, patients may have to pay a higher “down payment” when they begin treatment. Some orthodontists may also charge interest if patients miss a payment.

- Payment coupons, spread out for a defined period of time: With this option, patients might make a payment every month, like they would with a loan.

- Discounted pricing when patients pay the total cost of treatment up front.

- Financing treatment costs over time: With this option, patients may pay a lower amount each month, but keep paying it even after the treatment has ended.

Families who have a flexible spending arrangement (FSA) or health savings account (HSA) through an employer (see Flexible Spending Plans) may be able to use it to pay for orthodontic costs that their dental plan does not cover. But remember, they can only use money from their FSA or HSA after the service has been provided.

Families who are planning to use an FSA should make sure to keep track of how much money they will need to put away and decide whether they will pay in a lump sum or in installments over time. Also, they should make sure to check what documents they will need to provide to use their FSA or HSA. Sometimes the requirements might be different depending on how they are paying for the care.

How Much Will a Dental Plan Cover?

Dental plans usually cover 4 major classes of service. Each class is paid differently. These include:

- Diagnostic and preventive care, like cleanings, exams and x-rays: These services are usually covered in full (100%) up to a maximum charge amount per service.

- Basic restorative care, such as fillings, periodontal work, and root canals: These services are usually paid at a lower rate; 80% of a maximum charge amount per service is common.

- Major restorative care, such as crowns, bridges, and dentures: Plans usually pay 50% of a maximum charge amount per service for these services.

- Orthodontic services: Plans often cover up to 50% of the total charge for the services, up to a lifetime dollar maximum. This lifetime maximum is the total the plan will pay for all orthodontic treatment. It is usually separate from the dental maximum and, in some cases, may include charges for other services that are orthodontic-related but do not deal with “movement of teeth,” such as extractions of teeth to help create space.

You should also keep in mind that:

- Patients who are covered by a Dental Health Maintenance Organization (DHMO) will usually have fixed copayments for different types of orthodontic treatment.

- There is usually no deductible for orthodontic services.

- Adult orthodontic care often is not covered.

- Plans that cover orthodontic services may limit coverage to members or dependents under the age of 19 years and may require some chewing dysfunction to qualify for coverage.

Of course, not all plans cover orthodontic services, and each dental plan’s coverage may be different. It is a good idea for patients to check their dental plan booklet or contact their insurer or plan administrator so they understand how their plan works, what is covered, and what they can expect to pay out of pocket.

What If You’re Out of Network?

Sometimes, you may be outside of your patients’ plan network. If you are, these patients should make sure they find out how much they may have to pay. Different types of dental plans cover orthodontic care differently.

For example, a DHMO usually does not cover any out-of-network care, which means that the patients will have to pay the full cost. Or, if they have a fee-for-service plan that includes out-of-network care, the lifetime maximum may be lower than the full charge for orthodontic care (set at some percentage, such as 50%) and they will have pay for any treatment costs over that limit. A fee-for-service plan might also pay less for out-of-network services than in-network services.

In most cases, there is no major difference between the lifetime maximums for in-network and out-of-network services for orthodontics.

Help Your Patients Plan Ahead for Their Families’ Care

Patients who have a dental plan should read through their plan documents, ask their employer, or call their plan to make sure they know:

- The type of plan (like a DHMO or Dental Preferred Provider Organization [DPPO]);

- Which orthodontic services are covered;

- If and how their plan pays for out-of-network orthodontic services;

- The lifetime maximum amount for orthodontic services (they will have to pay the full cost above that limit);

- Whether there is an age limit to start and complete orthodontic care.

Also, you should discuss the cost and their payment options (such as paying a discounted price for the entire service up front) with your patients. Plus, they should find out if they can use the funds in their FSA or HSA. If so, they should make sure they understand how much they are going to have to pay, and when, so they know how much money to put away. They only can use these accounts after the services have already been provided.

You and your patients both can learn more about types of dental plans and how they cover care by referring to Dental Plans. And remember, encourage your patients to ask you as well as their dentist, employer, and insurer all the questions they need to know. Understanding their coverage and costs up front now will help you and them better plan for their family’s future and will give them another reason to smile.

Robin Gelburd, JD, is the president of FAIR Health, a national, independent nonprofit with the mission of bringing transparency to healthcare costs and insurance reimbursement. FAIR Health oversees the nation’s largest repository of private healthcare claims data, comprising more than 22 billion billed medical and dental charges that reflect the claims experience of over 150 million privately insured Americans. Follow on twitter @FAIRHealth.

Related Articles

Steer Your Patients to Clear, Unbiased Data and Resources

Rising Claims Reflect a Need for Better Oral Cancer Detection

One in Five Consumers Rarely or Never See the Dentist