|

|

Mindy Salzman

|

When talking to groups of dentists about embezzlement, I have noted their first instinct is to deny that it has ever happened to them. Current statistics, however, show that at least 60% of all dentists have already been the victim of embezzlement at least once. In a group of seminars I conducted in Australia and New Zealand, one dentist admitted to being a victim 3 times.

There are published lists of red flags, seminars offered, numerous articles in magazines, and books written on the topic, but the number of incidents keeps climbing. Of 10,000-plus dentists invited to a recent webinar on the topic, only 38 actually attended. Why the denial or lack of interest? Perhaps it is an embarrassment. It shows that you have not been minding the store. Maybe you are not aware it has occurred. In most cases, embezzlement is brushed under the rug and you move on to the next office manager who comes along.

A problem I face as a certified fraud examiner is that I can lead dentists in the right direction, but I cannot force them to implement necessary changes. I don’t know whether the suggestions are implemented when they go back to their offices. You can hang an embezzlement policy in a break room, but it is worthless if the policy is not enforced. When suggestions are not implemented, I get a call from the doctor saying he or she believes someone has been embezzling, and I am not surprised.

Because of your clinical responsibilities as dentists, you often become like an absentee owner. This puts your practice particularly at risk. Solutions require you get more directly involved in the day-to-day activities of the office. There is no easy answer to the problem, but being vigilant in implementing the suggestions below can certainly help.

Of those who do attend seminars or webinars, most ask questions about how to know if it has happened and what to look for. The first thing to do is to review security policies and practices. I help my clients review their systems to make sure their software has the necessary reports to track everything related to money. If their software doesn’t have the right reports, I recommend that they switch to a system that does. One of the systems I recommend is DentiMax because it has the right reports and is one of the few available systems that doesn’t break the bank.

Once I verify the software is up to speed, I discuss the importance of reviewing audit trails, holding team members accountable, and having everyone use his or her own login and password.

Immediately implement the following actions to help prevent embezzlement in your practice:

- Open your mail: Most dentists do not do this. Opening the mail and stamping the back of checks “For deposit only” followed by your account number deters a potential embezzler. You will have a good idea of what should be in the deposit each day, and it only takes a few minutes.

- Take the deposit to the bank daily: It is important for your team to know that you will be taking all the money—cash, checks, and credit card payment slips—out of the office each night. This is another vital deterrent. Even if you don’t get to the bank each day, the potential for theft is greatly reduced by this act alone.

- Change your routine: Arrive at the office at different times. Come in early, leave a few minutes later each day, or come back from lunch early. Come up to the front at different times throughout the day just to break up the routine so a potential embezzler doesn’t know when he or she will be alone in the office. If you see an employee’s car at the office in the evening or on a Saturday or Sunday, find out why. Someone who has to work extra hours may be cooking the books.

- Check the daily reports: Be sure to run daily reports—day sheet, deposit slip, and a copy of the schedule from the end of the day—and take them home with you. Compare them to be sure everyone who came in that day shows up on these reports. Also, make sure everyone in the office knows that you are checking this each day. Ensure that the deposit in your practice management software matches what you are taking to the bank.

- Require vacations: Be sure that each employee takes his or her allotted vacations. Many times embezzlement is discovered when the office manager or front desk person is out of the office. If given the choice, an embezzler will usually not take vacation because he or she needs to be in the office each day to cover the tracks.

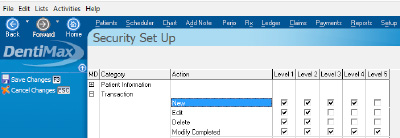

- Utilize security settings in your practice management system and review audit reports: Most practice management software programs have security settings. You can give team members a security level and then permit or restrict each from different actions in the software. This reduces access to the money in your practice.

Review these settings on a routine basis and follow up with employees on any unusual transactions in the log, such as deposits deleted and transactions modified or removed.

![]()

By just changing a few things in the office routine, you can help reduce the potential for fraud and embezzlement.

The Fraud Triangle, created by Donald Cressey, an American sociologist and criminologist, tells only 3 things need to be in place for fraud or embezzlement to occur:

- Motive: The need for money due to a drug habit, an illness, divorce, or just for the fun of it.

- Opportunity: If employees are aware of your daily routine, you open yourself up for embezzlement. The following situations create opportunities for employees to take advantage of you: giving someone signature authorization on your checking account, allowing employees access to the office at times other than normal working hours, allowing employees to make deposits, or not taking money to the bank each day. Probably the most important situation to avoid is becoming too friendly with employees.

- Rationalization: Many embezzlers have felt that they were owed money because they were underpaid, or they claimed the dentist was making so much money he or she wouldn’t miss it.

Consider these situations before you join your team members at the next happy hour, let one of them do you a favor and take the deposit to the bank, take cash from the drawer and put it in your pocket in front of team members, or invite team members to your newly remodeled home for dinner. Don’t give employees a reason to steal from you. They can create many on their own.

Remember: people do not tend to steal from someone they respect.

Protect the company you have spent so much time and effort in creating. Being aware of possible dangers and making small, but important, adjustments in your actions can protect your practice and let you do the thing you like best—care for your patients.

Ms. Salzman is a certified fraud examiner with 25 years of accounting experience. She has a degree in finance from Simmons College and a teaching certificate in business education from Salem State College. She has been a trainer in the dental and medical industries for more than 20 years, training clients on DentiMax, Total MD, Advanced MD, Medformix, Medinformatix, Softdent, PracticeWorks and Quickbooks Pro. Mindy’s specialty is helping doctors in the detection and prevention of embezzlement in their practices. With this expertise, combined with her accounting experience, she provides insight to clients about utilizing the software to run their practices in the most efficient way.