You think you know where your profits and losses are, but there may be vampires lurking in the shadows and sucking the lifeblood out of your practice. Your balance sheet may give you the big picture. To bring the bloodsuckers out into the sunlight, though, you need more specialized tools. Instead of stakes and holy water, we’re going to use some basic accounting principles.

Try not to be afraid as we embark on this journey into the spooky, unexplored castles of your bookkeeping. I realize that if you wanted to be an accountant, you’d be one. You wanted to be a dentist, and you are one. Unfortunately, that also makes you a business owner, so you’re going to have to learn some accounting basics anyway.

Most accountants are concerned with taxes and examining the business as a whole. Getting behind with Uncle Sam can be a nightmare, and we reward these people handsomely for keeping our books clean. However, there’s another type of accounting known as managerial accounting. Managerial accountants examine how you use your resources and which parts of the business might be causing unnoticed losses.

|

|

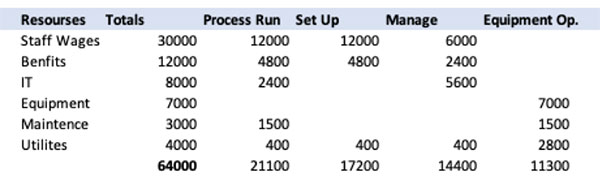

Figure 1. In determining allocation of resources, 40% goes to processing our production runs, 40% for setup, and 20% for management. |

You probably use most of the simpler tools already, as you review your monthly statements. (You do review your monthly statements, right?) For example:

collections – (expenses + taxes) = profits

Why don’t you have more profits? One common reason is that you’re not a psychic. You have no real way of predicting the services that you’ll provide in any given month. You create a quota system, because you’d have to do unnecessary work.

You know very well that certain procedures are more profitable than others. But do you really know what procedures those are? The reality is that there are procedures performed in every office that, below a certain volume, consume more resources than they create. These are your profit vampires.

To bring these thirsty fellows into the light, you can use an activity-based costing system (ABC). It will highlight the true cost and thresholds that need to be crossed to protect your bottom line.

Using ABC

Like any system, there are advantages and disadvantages. ABC is considerably more time intensive. For some offices, it may not be worth it. For others, ABC may highlight serious issues that cost them profits.

The average dental office is fairly complex, so let’s use a simplified example. You now own a small brewery. It makes four types of beer: Palate Pilsner, Incisal IPA, Whitening Wheat, and Aligner Amber.

|

| Figure 2. Drivers establish the rate at which resourses are being consumed. Then you divide the activity pool amount/total volume of the driver |

Step 1. Resources

Examine your resources. This is basically your monthly budget. It is what you have to spend on materials, labor, and overhead for your practice.

Step 2. Activities

Where do these resources go? How does your business spend the monthly budget?

Step 3. Pools

These are grouped activities that all go into providing our service. Similar activities can be put into the same pool to make calculations easier.

Step 4. Drivers

What determines the rate at which we use resources? Is it the hours you’re open, the number of beers you bottle and sell, the number you pack and ship?

Step 5. Cost Objects

Which products and activities consume the resources specifically?

When assigning cost, we need to look at the element impacted. Is this cost directly associated with the product, or is the cost being incurred to keep the whole business running? Here’s the breakdown:

- Facility cost: Shared costs across the organization

- Product cost: Shared cost across a product line

- Batch cost: Shared cost across production bundles (per batch, not based on volume)

- Unit cost: Individual product cost based on volume

|

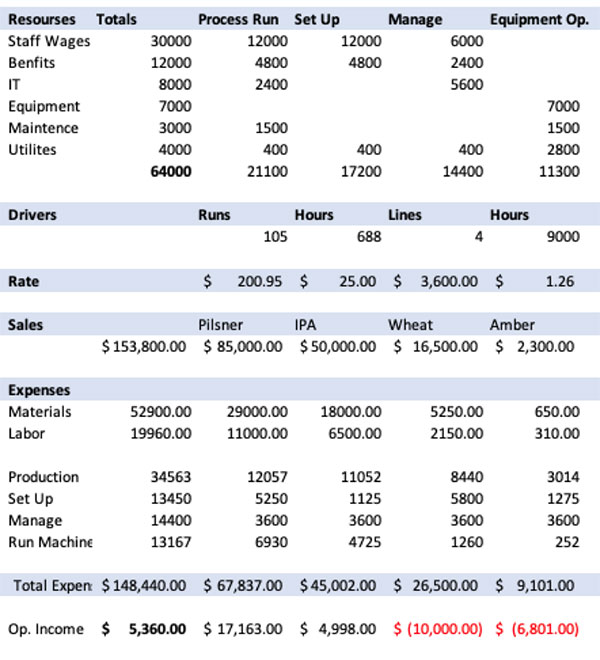

| Figure 3. Total expenses are subtracted from the sales figures, leaving the operating income per product line. |

Let’s Begin!

You’ll need to understand that some things will be subjective. As we begin to establish our “activity” groups, we know that every day is not exactly the same. Use estimates if you can’t firmly establish the allocations.

For our brewery, we’ve identified four basic activity groups: process runs, setup, management, and equipment operation.

Next, we need to determine how our resources are being allocated across these activities. This should be determined as a percentage and then applied to the budget. We have a $30,000 monthly expense for wages (Figure 1). We’ve estimated that 40% goes to processing our production runs, 40% for setup, and 20% for management. This process is continued down the chart.

After that, we need to bring in our drivers. This is going to establish the rate at which resourses are being consumed. Then you divide the activity pool amount/total volume of the driver (Figure 2).

Now that have our rates, it’s simply a matter of bringing in our sales and expense data. In our example, we established a driver rate of $200.95, and over the next month we produce 60 runs of Palate Pilsner. This would create a total allocation of $12,057. This method is then repeated across the other beers.

These total expenses are then subtracted from the sales figures, and we are left with our operating income per product line. What you’ll clearly notice is that we’re losing money on two of the four beers that we’re producing (Figure 3).

Breaking out the costs by activity lets us see that while our brewery is profitable, on average, certain brews are losing money. Similarly, in your practice, you might discover that certain procedures are money losers, not money earners, because of the time they take or the materials you need to keep on hand for them, or because they require setup and cleanup that uses too much staff time.

Once you’ve spotted the vampires, you can take a closer look at why they’re losing money and see if there are ways you can change your scheduling, marketing, or use of space to improve returns on them. The ABC method may have forced you out of your current business analysis comfort zone, but it will help you achieve a vampire-free practice so you can continue to grow.

Mr. Moriarity, MA, FA, MBA, spent years working with attorneys and physicians before coming into dentistry in 2008 (just in time for all the fun). As a national speaker and as the vice president of client development for the Productive Dentist Academy, he has been able to share tactics and ideas from coast to coast, helping hundreds of dental offices grow their businesses and better serve the communities they love. He also is the author of the award-winning book, Catchy Title Here: 30 Micro-Courses on Marketing, Business, Leadership, and Motivation Based on the Principles of Behavioral Economics. He can be reached at chris@productivedentist.com.

Related Articles

The Problem of Overproduction—Or, Why You Don’t Want Great Days

So You Want to Be a Practice Management Consultant

Look Outside Dentistry for Hires Who Want to Work