Dentists do more than drill and fill. According to a national study of 400 practice owners and associates, from Bankers Healthcare Group, most practitioners are very involved in the financial aspects of managing their practices.

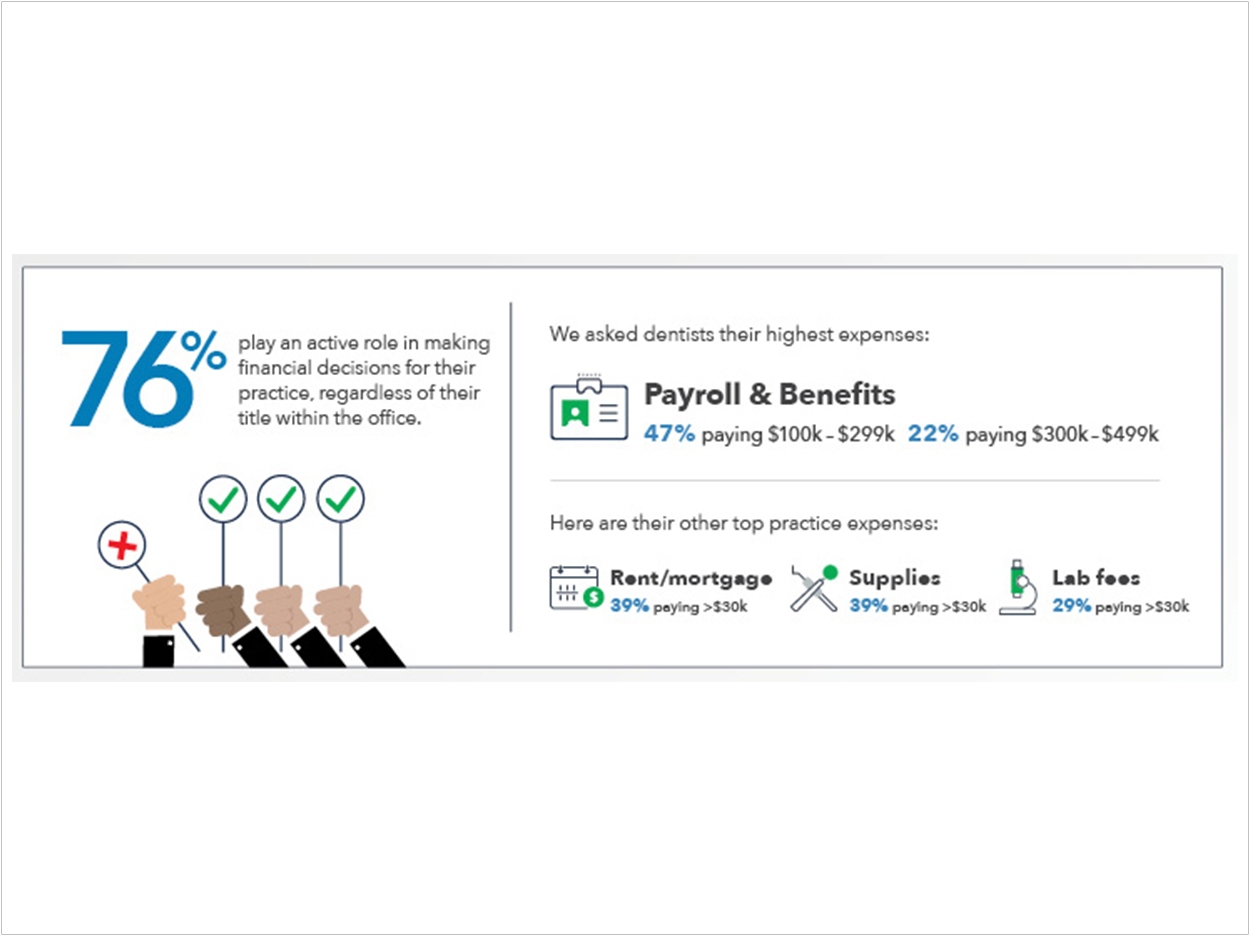

For example, 76% of those surveyed play an active role in making financial decisions for their practice, regardless of their title within the office, including budgeting, investments, and borrowing.

Among practice owners, 60% make financial decisions on their own, while 27% make them jointly with others. The remaining 13% are hands-off in financial decision-making, relying on practice partners, office managers, or financial advisors.

Those age 35 and older skewed higher on sole decision-making, while younger practice owners were more likely to tap other experts. But among associates, those age 35 to 49 who practice with two or fewer other dentists are more likely to be involved in financial decisions.

Practice owner also say that payroll and benefits are their highest expenses, with 47% estimating an average annual spend between $100,000 and $299,000, while 22% estimate spending between $300,000 and $499,999.

Hiring office staff is the most frequently incurred significant financial investment, with a quarter of respondents hiring every two or three years, and another 22% hiring annually. Upgrading or purchasing new equipment also is a frequent financial move, with 20% indicating they’re likely to do so every year. Other top annual practice costs include:

- Dental supplies: 32% report spending more than $30,000.

- Office rent/mortgage: 39% spend more than $30,000.

- Lab fees: 29% of owners estimate they spend more than $30,000.

Lower annual expenses include marketing, with 43% spending less than $3,000, and continuing education, with 41% spending less than $3,000.

Plus, 44% of those surveyed said they’ve taken out a commercial loan, and 40% have taken out a personal loan. The most common uses for these business loans included starting or opening their practice (50%), getting working capital (41%), and financing expansion or equipment (32%).

Related Articles

Evolving Practices Need Dental Equipment Financing

Ignore the Business Side of Your Practice at Your Peril

Focus On: Key Financial Issues